President and Chief

Executive Officer

Cloud‑based medication history business and school DX business are performing strongly.

Thank you very much for your continued support.

In order to enhance its corporate value over the medium to long-term, the Group is aggressively working on the healthcare business and the school DX business, both of which are expected to expand in the future, with the aim of achieving sales and profit growth in both businesses.

Overview of financial results for FY2025

Consecutive increases in revenue and profit. Profit reached a record high.

We have announced the financial results for the fiscal year ending September 2025 on November 11.

For the consolidated results, thanks primarily to strong sales growth in the healthcare business and the school DX business, net sales reached ¥29.9 billion and operating profit ¥2.95 billion, marking two consecutive years of increased revenue and profit.

In the healthcare business, the cloud‑based medication history system achieved strong growth due to successful sales promotion toward mid‑sized and larger dispensing pharmacies and drugstores.

In the school DX business, significant increases in both revenue and profit were achieved through expanded adoption of the cloud‑based school affairs support system “BLEND” at private schools and initial sales to public schools.

Approah in FY2026

Given its significant future growth potential and its ability to become a stable, recurring business by building long‑term relationships with our customers, we will pursue various initiatives to grow both revenue and profit.

For the cloud‑based medication history system, strong customer demand from dispensing pharmacies continues, and we plan to further expand the number of installations to contribute to the business’s revenue and profit growth. Additionally, to promote greater operational efficiency across dispensing pharmacies, we will actively support cloud‑migrations—including the Group’s pharmacy DX solutions—and thereby drive improved profitability.

For childcare DX, with the government’s push to digitize maternal and child health information as a backdrop, we will further expand adoption of the maternal health record book app “Boshimo” by municipalities and strongly promote expansion of childcare DX services centered on these clients, developing this business into a core profit‑contributing pillar of the healthcare business.

School DX business

We will continue promoting adoption at private schools, and, motivated by the government’s initiative to advance school administration DX within prefectural jurisdictions, we will actively engage in new orders from public schools and aim to achieve further growth in revenue and profit through an increase in the number of schools adopting our solutions.

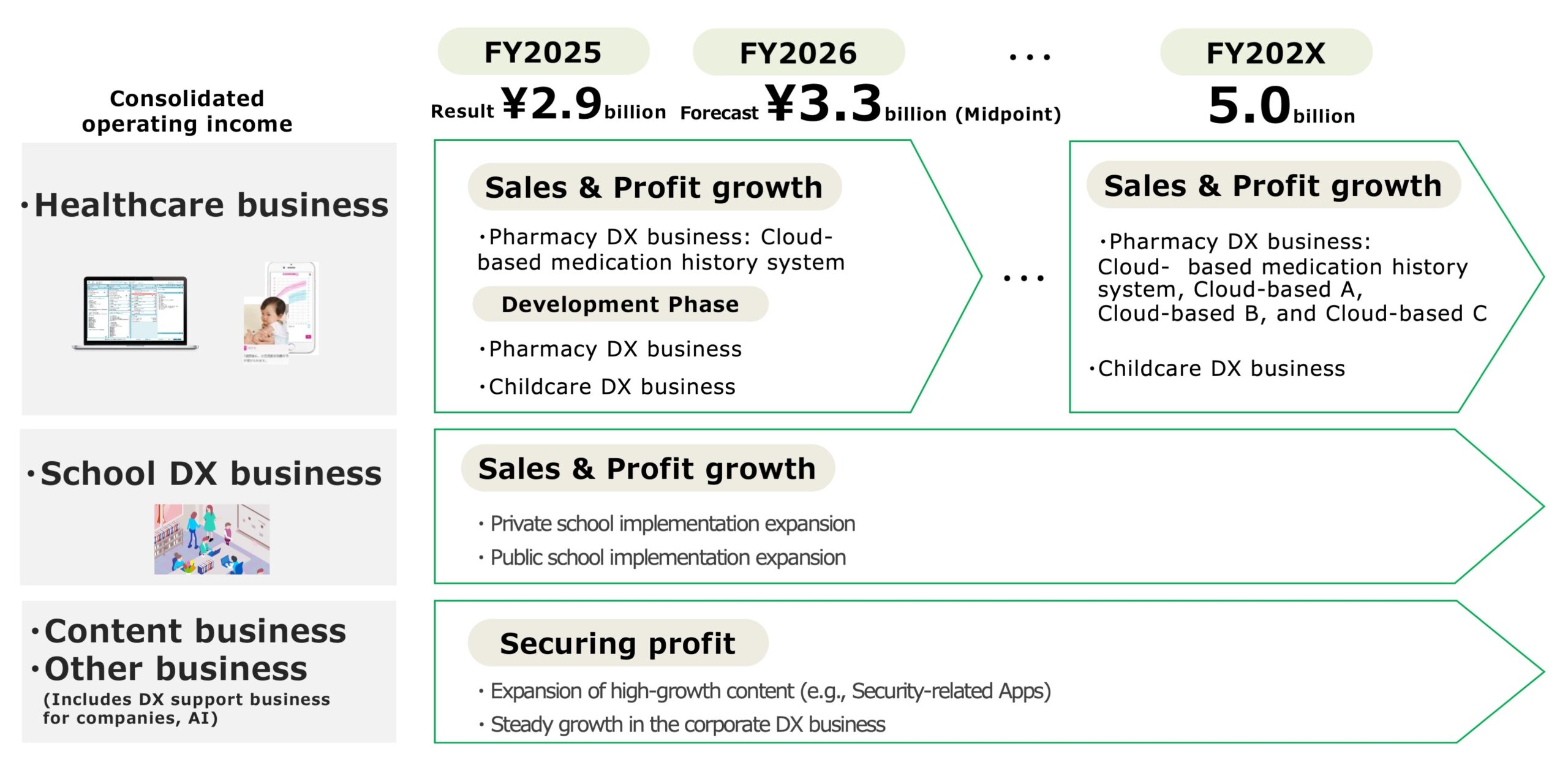

Image of medium- to long-term profit

School DX business: short‑ to medium‑term contributor

Healthcare business: medium‑ to long‑term contributor

We expect the school DX business to contribute most significantly in the short‑ to medium‑term, and the healthcare business to contribute in the medium‑ to long‑term. Through profit growth in both businesses, we aim to update our record for highest operating profit.

We hope that we can continue to count on your support as we pursue our initiatives.

November, 2025