The important issues identified by the Company include the enhancement of market capitalization through the creation and the expansion of corporate value, and the continual distribution of dividends.

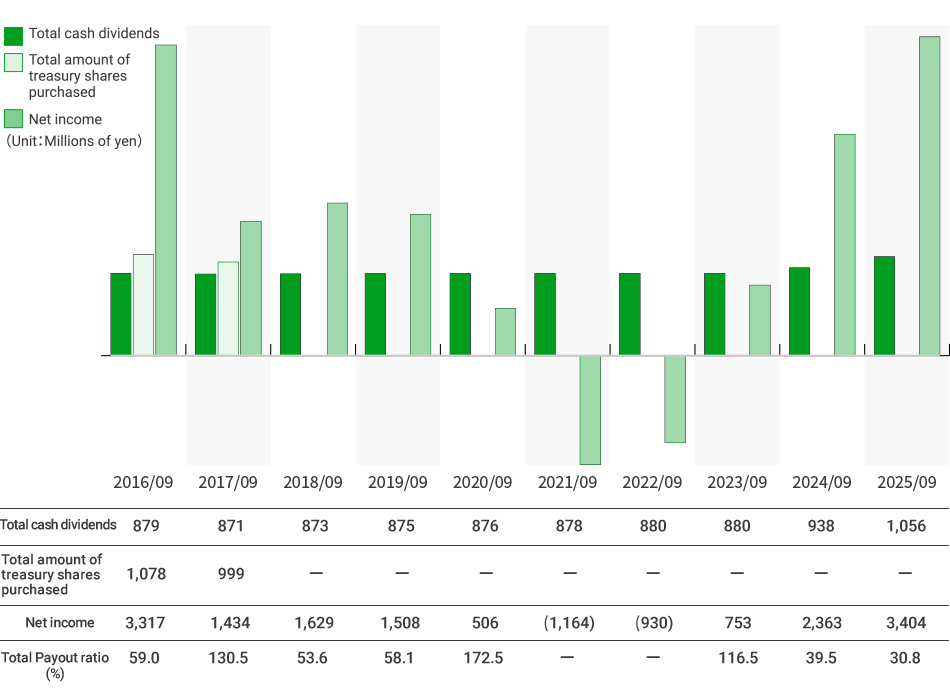

In distributing profits, the Company aims to provide shareholder returns with a total target payout ratio of 35% in the medium term. To achieve this goal, the Company will remain true to its basic capital policy of achieving sustainable medium to long-term growth in net sales and income while returning profits to the shareholders, and work to secure a sufficient amount of internal reserves to carry out aggressive business development in the future.

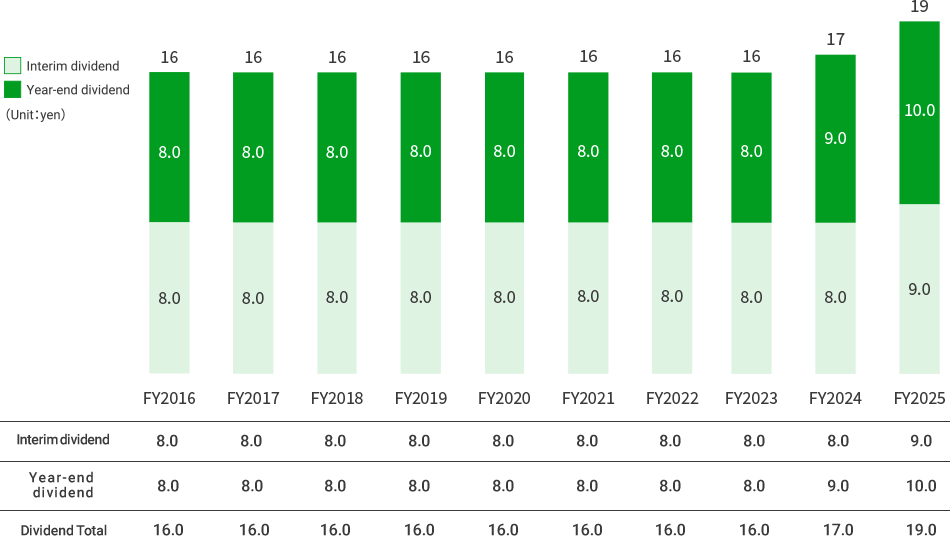

Dividend Information

Interim dividend base date: March 31

Year end dividend base date: September 30

Dividend information is calculated based on the figures after the following share splits.

・We conducted a 2-for-1 share split which became effective as of April 1, 2015.

Total Payout ratio

Total payout ratio=(Total cash dividends+Total amount of treasury shares purchased)/Net income×100